Starting a new business venture can be an exhilarating yet challenging journey. While passion, dedication, and a solid business plan are essential, securing adequate funding is often a critical factor in turning your entrepreneurial dreams into reality. This is where angel investors come into play. Angel investors are individuals who provide financial backing to early-stage startups in exchange for equity or convertible debt. They not only offer crucial capital but also bring valuable expertise, mentorship, and networking opportunities to the table. In this article, Founderfb will explore the world of angel investors for startups and discuss how to find the right support for your business.

Angel Investors for Startups: Finding the Right Support for Your Business

- Understanding Angel Investors

Before diving into the process of angel investors for startups finding angel investors, it is important to understand who they are and what they bring to the table. Angel investors are typically high-net-worth individuals who are willing to invest their own capital in promising startups. Unlike venture capitalists who manage funds from multiple investors, angel investors usually invest their own money. They are often successful entrepreneurs or business professionals with industry-specific knowledge and experience. In addition to funding, angel investors offer guidance, mentorship, and access to their networks, which can be invaluable for startups.

- The Benefits of Angel Investment

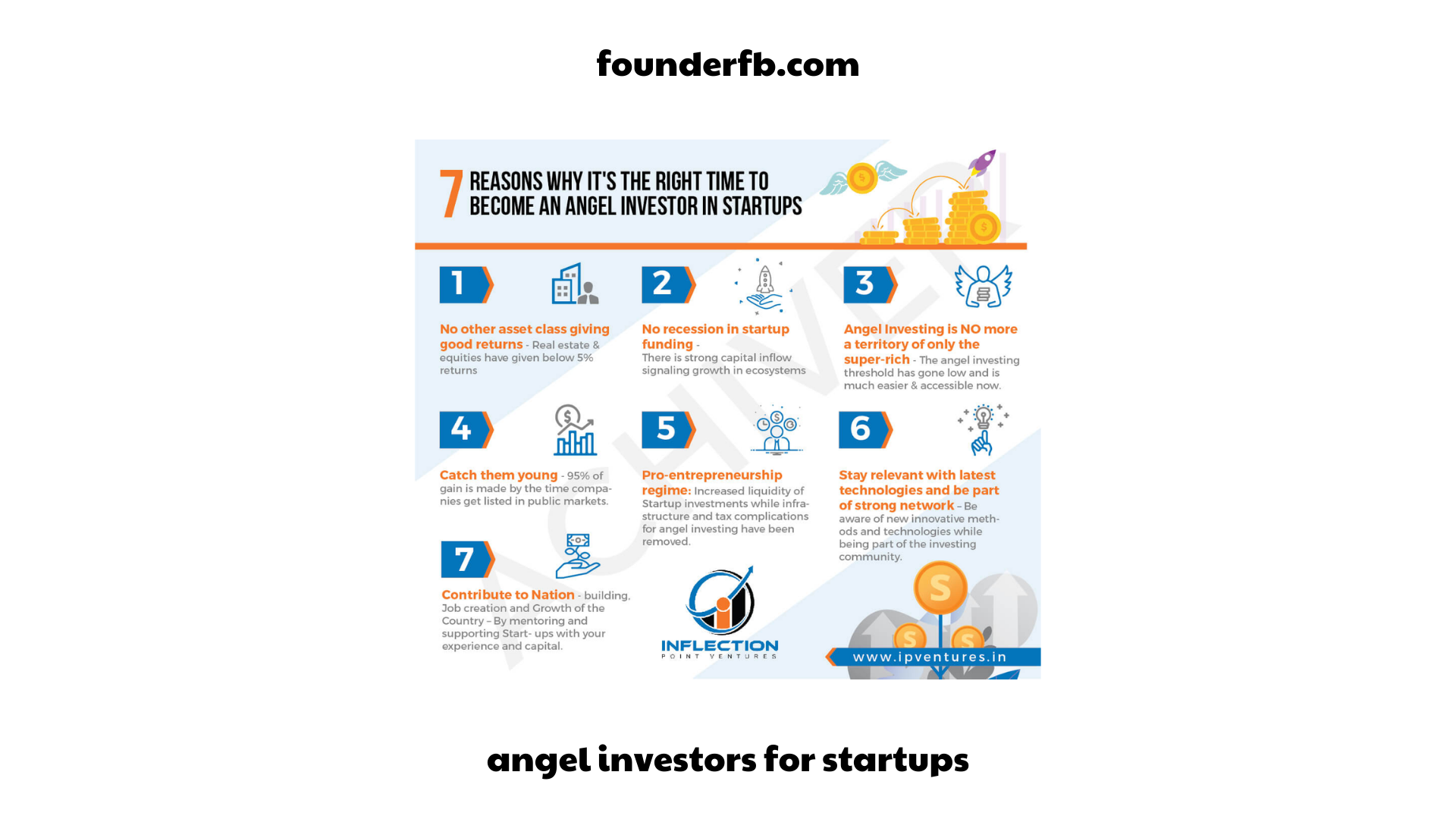

Securing funding from angel investors offers angel investors for startups several advantages for startups. Firstly, angel investors provide the much-needed capital to fuel the growth of your business. This capital can be used for product development, marketing, hiring key team members, or expanding operations. Secondly, angel investors often bring a wealth of industry knowledge and experience. They have been through the startup journey themselves and can offer valuable insights, advice, and mentorship. Additionally, angel investors can open doors to their networks, connecting startups with potential customers, partners, or future investors. Their expertise and connections can significantly enhance the chances of success for startups.

- Defining Your Funding Needs

Before seeking angel investment, it is crucial to have a clear understanding of your funding needs. Evaluate your business plan, identify the areas that require capital infusion, and determine how much funding you need to achieve your milestones. This will help you communicate your funding requirements effectively to potential angel investors. Having a well-defined plan and financial projections will not only instill confidence in investors but also showcase angel investors for startups your preparedness and professionalism.

- Identifying Angel Investor Networks

One of the most effective ways to find angel investors is by tapping into angel investor networks. These networks bring together accredited angel investors and startups seeking funding. Angel investor networks can be region-specific, angel investors for startups industry-focused, or have a broader reach. They provide a platform for startups to pitch their ideas, connect with potential investors, and gain exposure to a pool of interested angel investors. Research and identify angel investor networks that align with your industry, location, and funding requirements.

- Leveraging Online Platforms

In addition to angel investor networks, online platforms have emerged as popular channels for connecting startups angel investors for startups with potential investors. Websites and platforms dedicated to angel investment allow startups to create profiles, showcase their business, and connect with interested investors. These platforms often have search filters that help investors find startups based on industry, location, or investment size. Some platforms even provide additional resources, such as educational content, pitch templates, and investor communication tools. Examples of popular online angel investment platforms include AngelList, Gust, and SeedInvest.

- Networking and Industry Events

Building a strong network and attending industry events can also be fruitful in connecting with angel investors. Attend startup conferences, industry trade shows, and networking events to meet like-minded entrepreneurs and potential investors angel investors for startups. Engage in conversations, share your business ideas, and seek opportunities to pitch your startup. Building relationships and establishing rapport with angel investors can increase your chances of securing funding. Additionally, seek out local business incubators, accelerators, and entrepreneurial organizations, as they often have connections to angel investors and can provide guidance on the fundraising process.

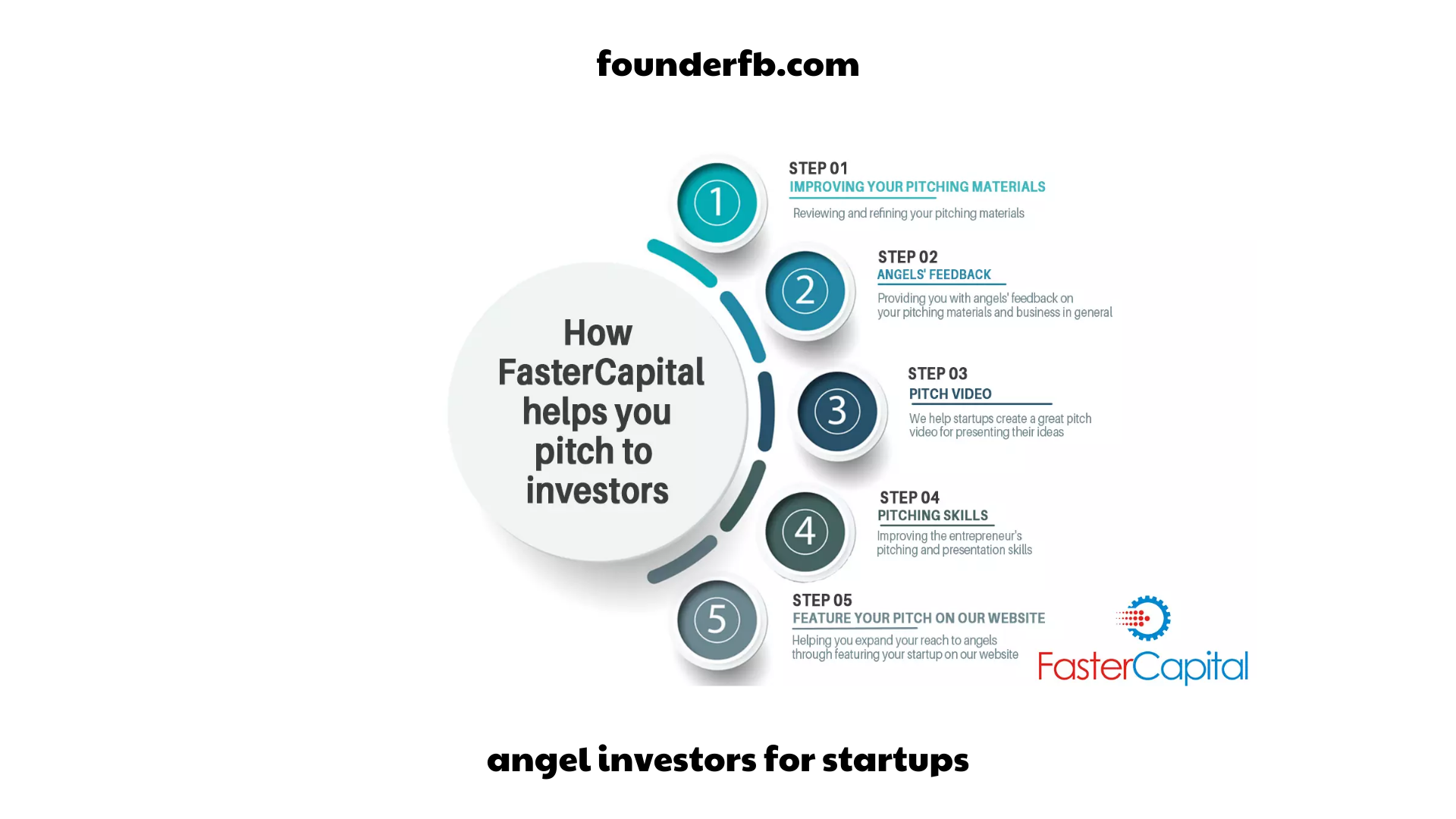

- Crafting an Effective Pitch

When seeking angel investment, a well-crafted pitch is crucial. Develop a compelling pitch deck that highlights angel investors for startups your business idea, market potential, competitive advantage, and financial projections. Clearly articulate your funding requirements and how the investment will be utilized to drive growth. Practice your pitch to ensure it is concise, persuasive, and engaging. Remember, angel investors receive numerous pitches, so it is important to make yours stand out.

- Due Diligence and Negotiation

Once you have caught the interest of angel investors, they will likely conduct due diligence on your startup. Due diligence is the process of evaluating the viability, scalability, and potential risks of your business. This may involve reviewing your business plan, financial statements, market research, and talking to key team members. Be prepared to answer questions and provide additional information as requested. If the due diligence process is successful, negotiation of terms and valuation will follow. It is important to strike a balance between securing favorable terms for your startup and meeting the expectations of the angel investors.

- Building a Strong Investor-Entrepreneur Relationship

Securing investment is just the beginning angel investors for startups of your journey with angel investors. Building a strong investor-entrepreneur relationship is crucial for long-term success. Keep your investors informed about the progress of your business, milestones achieved, and any challenges you may be facing. Regularly communicate through updates, reports, and meetings. Be open to feedback and advice from your angel investors, as they have valuable insights to offer. Nurture the relationship and leverage their expertise and networks whenever needed.

- Conclusion

Angel investors play a vital role in the angel investors for startups ecosystem by providing not only financial support but also guidance, mentorship, and networking opportunities. Finding the right angel investors for your business requires thorough research, networking, and effective pitching. By understanding the benefits of angel investment, defining your funding needs, and leveraging various channels such as angel investor networks, online platforms, and industry events, you can increase your chances of securing the right support for your startup.

Remember to build strong relationships angel investors for startups with your angel investors for startups and keep them engaged throughout your entrepreneurial journey. With the right angel investors by your side, you can navigate the challenges of early-stage startup funding and propel your business towards success.