Starting a new business can be an exciting and rewarding venture, but it often requires a significant amount of capital to get off the ground. For many aspiring entrepreneurs, securing financing is a crucial step in turning their dreams into reality. This is where business loans for startups come into play. These loans provide the necessary funds to cover initial expenses, purchase equipment, hire employees, and establish a strong foundation for growth. In this article, Founder will explore various funding options available to startups and how these business loans can help launch your dream.

Business Loans for Startups: Funding Options to Launch Your Dream

- Traditional Bank Loans

Traditional bank loans are one of the most common options for obtaining financing for a startup. These loans are typically offered by commercial banks and require a thorough application process. Banks evaluate factors such as the borrower’s credit history, business plan, and collateral before approving a loan. While business loans for startups may offer lower interest rates compared to alternative lenders, they often require a solid credit history and collateral, making them more challenging for startups with limited financial resources. However, if you can meet the requirements, a traditional bank loan can provide you with the necessary funding to kickstart your business.

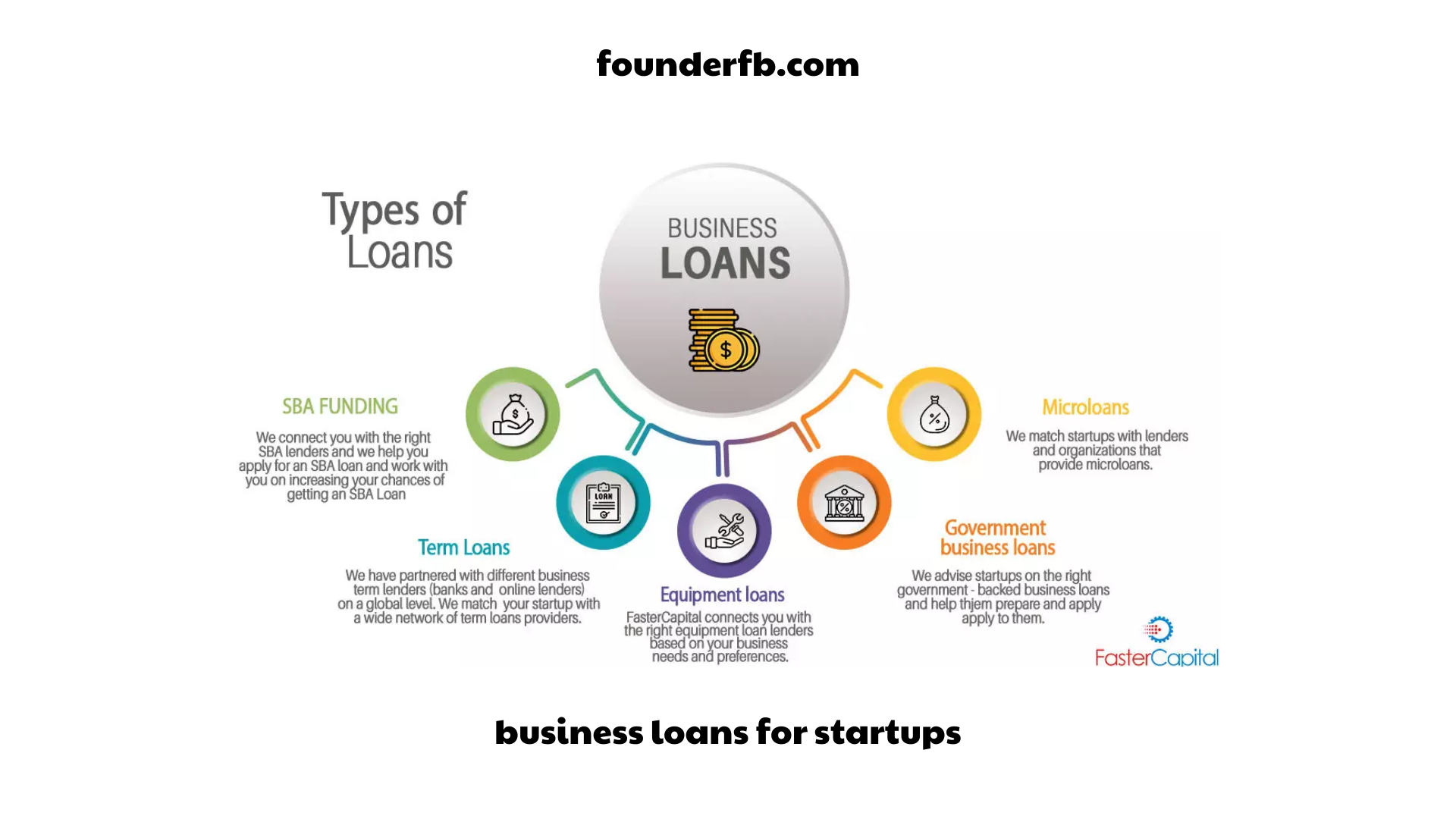

- Small Business Administration (SBA) Loans

The Small Business Administration (SBA) offers loan programs specifically designed to assist startups and small businesses. SBA loans are partially guaranteed by the government, which reduces the risk for lenders and increases the chances of approval for borrowers. The SBA provides various loan programs, including the 7(a) loan program, which offers general-purpose loans, and the Microloan program, which provides smaller loan amounts. These loans often have longer repayment terms and competitive interest rates, making them an attractive option for business loans for startups. However, the application process can be rigorous, requiring detailed business plans and financial statements.

- Online Lenders

In recent years, online lenders have emerged as a popular alternative to traditional banks for startups seeking financing. Online lenders use technology to streamline the application process and provide faster access to funds. These lenders typically have less stringent requirements compared to banks, making business loans for startups more accessible to startups with limited credit history or collateral. Online lenders may offer a variety of loan options, such as term loans, lines of credit, or invoice financing, catering to the specific needs of startups. However, it’s essential to carefully review the terms and interest rates before committing to an online loan, as they can vary significantly.

- Crowdfunding

Crowdfunding has gained significant traction as a financing option for startups in recent years. Through crowdfunding platforms, entrepreneurs can raise funds by soliciting small contributions from a large number of individuals. This approach allows startups to validate their business ideas, generate early interest, and secure funding from a broad audience. Crowdfunding can take various forms, such as rewards-based crowdfunding, equity business loans for startups, or donation-based crowdfunding. Each type has its unique benefits and considerations, so it’s crucial to choose the right platform and strategy that aligns with your business goals.

- Angel Investors

Angel investors are individuals or groups who provide capital to startups in exchange for equity ownership or convertible debt. These investors often have experience in the industry and can offer valuable mentorship and guidance in addition to funding. Angel investors are typically more willing to take risks on early-stage startups and may be more flexible than traditional lenders. However, securing angel investment can be a competitive process, as investors carefully evaluate the potential return on their investment. It’s essential to have a compelling business plan and a strong pitch to attract angel investors.

- Venture Capital

Venture capital (VC) firms provide financing to startups with high growth business loans for startups in exchange for equity. VC firms typically invest in startups during the early stages of development and provide substantial amounts of capital to fuel rapid growth. In addition to funding, venture capitalists often bring industry expertise, networks, and strategic guidance to help startups scale their business. However, securing venture capital can be highly competitive, as VC firms receive numerous pitches and carefully select the most promising opportunities. Startups seeking venture capital should be prepared for a rigorous due diligence process and be willing to give up a portion of their ownership in exchange for funding.

Startups may also explore grants and government programs as potential sources of funding. Many organizations, including government agencies, non-profit foundations, and research institutions, offer grants to support innovative startups in specific industries or sectors. These grants do not require repayment and can provide a significant boost to a startup’s capital. However, the application process for grants can be highly competitive, and startups must demonstrate their alignment with the grant’s objectives and requirements. Researching and identifying relevant grant opportunities can be time-consuming but can yield substantial financial support if successful.

Conclusion

Securing funding for a startup is a critical step in transforming your entrepreneurial vision into a thriving business. Business loans for startups provide the financial resources necessary to cover initial expenses, establish operations, and fuel growth. Whether through traditional bank loans, SBA loans, online lenders, crowdfunding, angel investors, venture capital, or grants, there are various funding options available to business loans for startups to the unique needs of startups. Each option has its advantages and considerations,and it’s essential for entrepreneurs to carefully evaluate their financing needs, eligibility requirements, repayment terms, and potential impact on ownership and control.

By exploring these funding options and choosing the right business loans for startups for their business, startups can secure the necessary capital to launch their dream and set themselves on the path to success. Remember, along with funding, it’s important to have a well-developed business plan, a clear vision, and the determination to navigate the challenges that come with starting a new venture. With the right funding and a solid foundation, you can turn your startup into a thriving business and make your entrepreneurial dreams a reality.